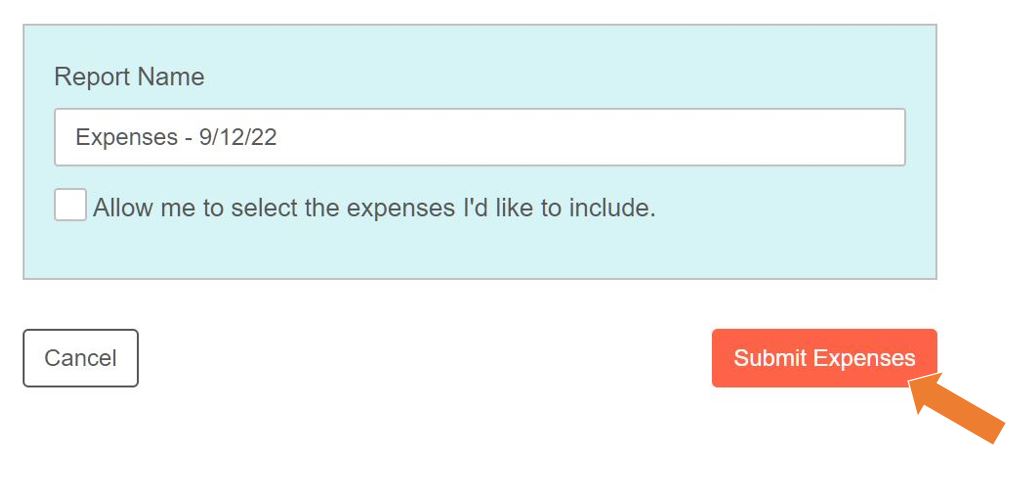

One common issue our consultants face when submitting expense reports is submitting multiple reports for the same project. We suggest simplifying the process by double checking that you have all meals, hotels, rental cars, and any other expenses accounted for on this specific project before submitting the report. This minimizes the chances of not being reimbursed for something or having to submit a second bill to a client for a project that had already been closed.

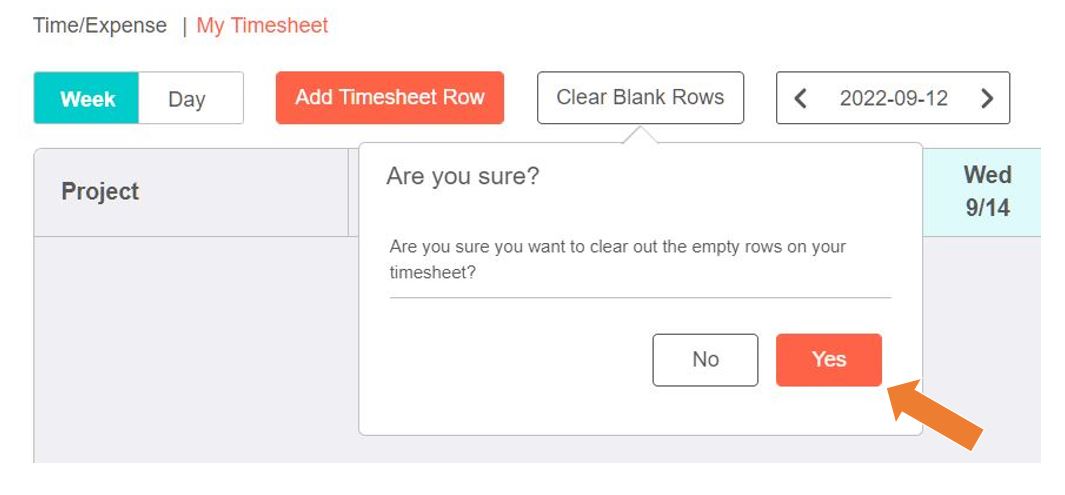

Our consultants work hard and sometimes have multiple projects open at the same time. Due to this, we have seen some consultants submit hours and expense reports under the incorrect project, which would result in the client being incorrectly billed. We suggest clearing out previous projects in BigTime by selecting “Clear Blank Rows,” which will make only current projects show up in the area to report hours. If a consultant realizes they have entered hours under the incorrect project, they should email our accounting department as soon as possible. It is much easier to correct the issue sooner, rather than realizing the hours are incorrect when preparing the final bill for a client.

When entering your expense reports, please keep in mind that our Accounting Department will also need the exchange rate for each place visited during the trip. If you are working overseas and travel to multiple countries or areas, you will need to include each exchange rate and note which receipts correspond to the exchange rate.

Our last piece of advice: when in doubt, contact accounting! Our accounting team is more than happy to answer questions and fix issues ahead of time, rather than finding them later in the process.

Creating a Supportive Workplace: Recognizing and Addressing Mental Health

AI in Clinical Trials: Transforming Research and Regulation

FDAQRC's Retreat and Reconnect

Pharmacovigilance: Insights, Challenges, and Future Horizons

The Future Looks Bright

FDAQRC Named a 2024 Aggie 100 Honoree

Celebrating 14 Years of Excellence